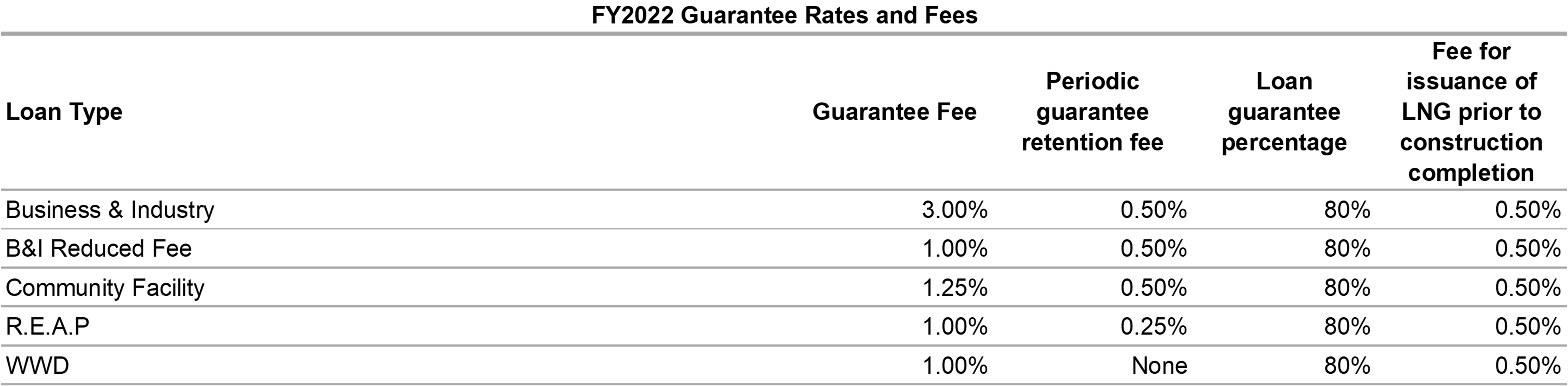

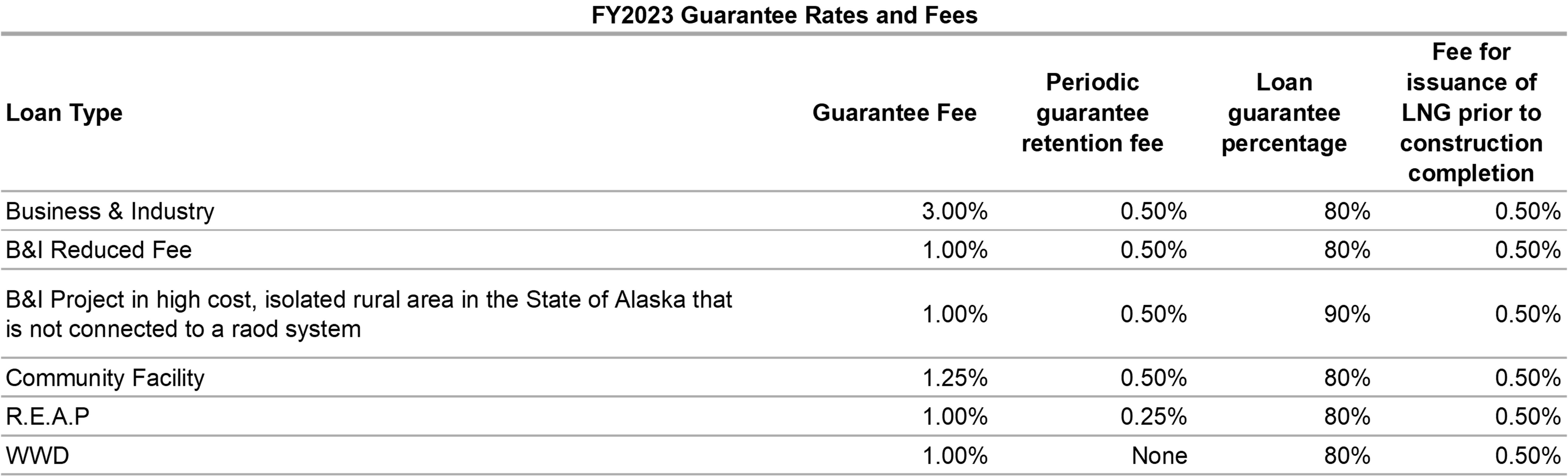

Above is the FY2023 Fee structure which lines up directly with the FY fee structure at the end of this post.

I will continue to be critical of funding issues that have been persistent in the USDA program for years. The B&I program is currently out of funds with more than $750MM in pending loan applications. The FY23 funding levels will be more than 1/2 expended if all of those loans were approved and funded. While that is a bit of an overreaction, the USDA and OMB must step up and find additional funding for this program.

Another opinion that may not be popular would be to increase the guarantee fee to the max allowed by 5001.454 and expand the guarantee fee reduction parameters to focus on loans in areas that need economic improvement. If the loan were more expensive, the program’s popularity would decrease but those projects in distressed communities or projects that improve the economy in the rural towns they are in should be rewarded with a reduced guarantee fee.

I feel like the focus on job creation in the regulations is lacking. Right now all you get is some priority points which I don’t is enough. There should be a metric to allow for the relaxation of some regulations where projects employ over 50 or 100 people, for instance. One such regulation is the fully secured “requirement.” It is very difficult to bring major manufacturing facilities to rural communities due to the value of CRE in those communities paired with the cost of new equipment. Many facilities need other governmental support or a 35-40% injection to meet collateral coverage. This is a major missed opportunity for the USDA to create jobs in distressed and rural economies.

The pending Farm Bill negotiations will be key for the future of this program and its ability to serve rural Americans. Is it crazy to want $4 billion in funding for B&I? Probably, but it would be great to see!